Lovable is the best company I’ve ever backed.

Lovable just raised a Series B! Here is our back story.

My first angel investment was in Cruise Automation and was my best. Now Lovable is my best investment ever.

The Cruise story starts in grad school, where I focused on robotics, and then I worked on the DARPA Urban Challenge at iRobot in 2007. Around then I emailed Kyle Vogt of Justin.tv the first time because I was working on video streaming for robotics. They helped inspire my founding my first startup that got into YC like them. After that, I didn’t work in robotics for a while, so my ideas were building up. After sharing them over lunch with Ayden Senkut of Felicis, he said I should talk to Kyle, who had just started Cruise. We met, I loved the plan, and asked to invest in late 2013, pre YC. They sold to GM for $1B at lightning speed and returned 62X.

It’s funny when your first investment is that good. Investing is easy! Regression to the mean was inevitable. I founded Tango.vc in 2020 to back AI, ML, and Robotics companies. There were some challenges exiting ZIRP (higher rates mean less cash for late stage VC). Tango.vc Fund I has backed a few standout companies including Stoke Space and Freshpaint.

The Lovable story starts with the previous startup too. I met the team at Depict.ai in the S20 YC batch at Demo Day. Depict makes AI tools for ecommerce, like advanced search and suggested product bundles, and I loved their GTM tactics. The CEO told me a cofounder left because “he was AGI pilled.” That immediately piqued my interest to look into what he was working on. It was Anton Osika, working on GPT-Engineer, which looked incredible and eventually became Lovable.

I invested in the preseed in 2023. They started 2025 with a few million ARR, but scaled to $200M ARR this year. It’s such absurdly fast growth that it makes me double check the numbers. The product is incredible: Lovable lets non-technical people create internal tools, prototypes, and websites by just writing plain English. They’ve also just baked Lovable into ChatGPT, so you can build real apps right from their chat.

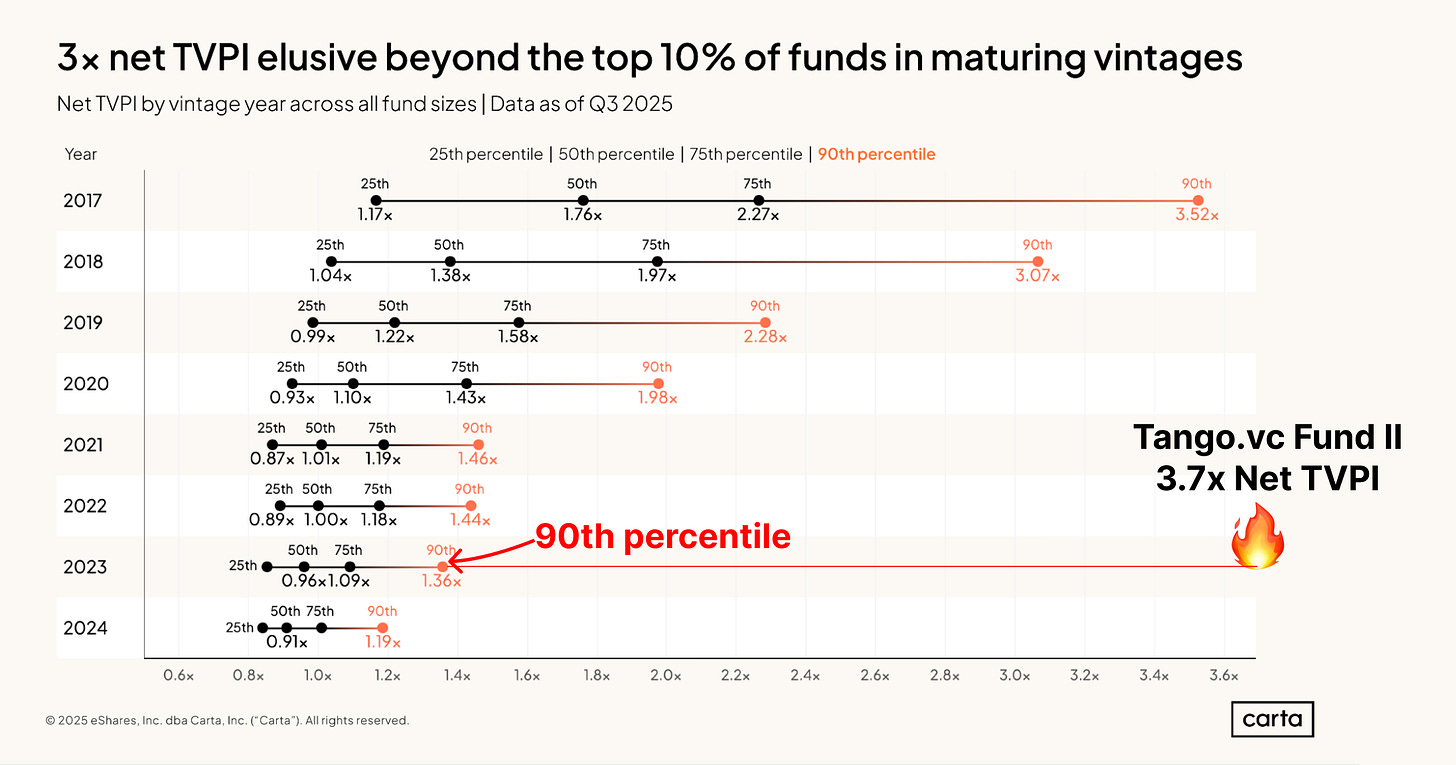

Lovable just announced their Series B. We invested out of Tango.vc Fund II and now this investment is the best in the portfolio. Our original investment is now worth 160X. The Net TVPI for Tango.vc Fund II is 3.7X. That means net of fees the Total Value of the fund is 3.7X the Paid In capital.

How good is that? Carta is a fund admin that tracks metrics that help compare performance. Usually funds take time to build value, so younger funds have lower multiples. I took their data about net TVPI across vintages and added Tango.vc Fund II which is well above the 90th percentile. It’s literally off the chart, which I enjoyed graphing below.

I’m currently raising Tango.vc Fund III. If you’ve like to become an LP, email me: ivan@tango.vc

And a heartfelt thank you to Anton and the whole team at Lovable. My job is really easy compared to yours, and I’m amazed by the pace of your progress.

For me, this whole story is so very Silicon Valley. I shared ideas with Kyle because the work at Justin.tv was interesting to me. Live streaming is not obviously related to robotics, but those that know the tech know the connection. Seed stage investing is very collaborative; Aydin didn’t need to share the insider knowledge about a new company. And then I met Depict at YC Demo Day. Their ideas and traction were excellent. But the best founders are compelled to build, like Anton starting the epic next company. The lesson for those aspiring: cultivate a sincere desire to build great things and always support each other along the way. That’s what makes Silicon Valley unique.