Tango.vc invests in AI, ML, and robotics startups. It’s been a great time to be an AI investor, with more challenges for capital intensive hardware companies.

We raised Tango.vc Fund I starting in 2020 and that fund is now fully deployed. There are over 52 investments across 46 companies. Fund II is closed, and we’re in the middle of deploying it. We’re writing $100K to $250K checks in preseed and seed stage startups.

Read on to learn about some Tango.vc Fund II companies, 3 lessons learned, a note on Fund III, and news about my new startup.

Fund II Companies

Let’s walk through a few companies currently in Tango Fund II. This isn’t a complete list, but gives you a sense of what we like.

Some companies are follow up investments from Fund I, like Vici Robotics which makes shelf stocking robots and Clone Robotics which makes humanoids. Check out Clone’s grip!

Some companies are new, but with founders from Fund I. The insight gained from working directly with a founder is impossible to replicate. Lovable is making software development AI. PitPro is building robotic fleet vehicle maintenance.

Ion Design can turn a Figma design into working React code. I’m personally eager to level up with their design system too.

Adagy Robotics helps companies with autonomous robotics save the robots with remote teleoperation when they get stuck.

Superfocus is building AI that doesn’t hallucinate, which is crucial in cases like customer support.

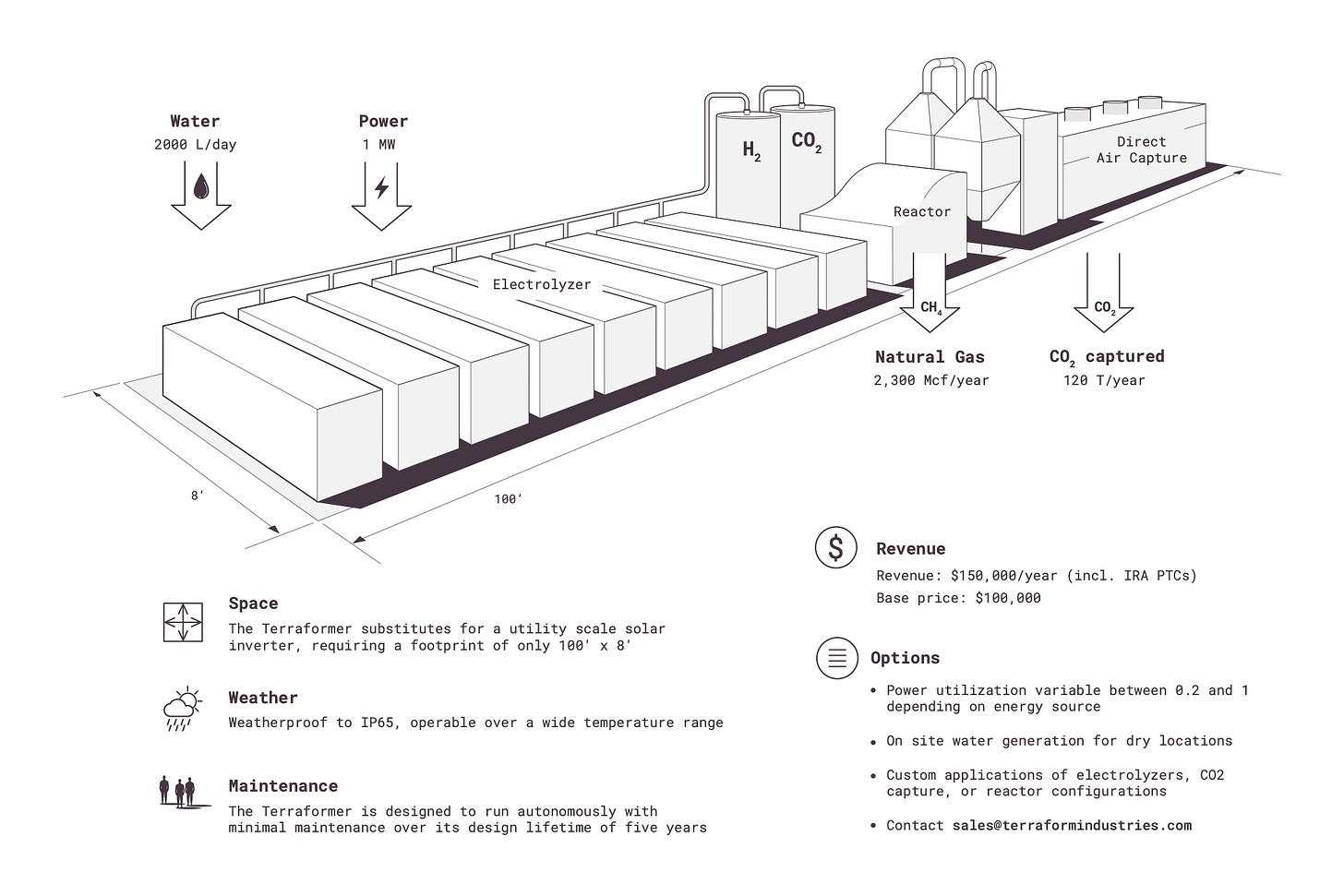

Terraform Industries makes methane from direct air captured CO2, all solar powered. This means methane, an important industrial input, can be climate neutral.

1. Reserves Are About Conviction

I had planned to invest in later rounds via special purpose vehicles (SPVs). My thinking was that building up a network of founders across more companies was the best use of funds. It also seemed weird to have multiple stages of investing, starting at Seed and following up at Series A or Series B.

Unfortunately the pull back in the market was timed with some great opportunities. With SPVs, the LPs decide per deal which investments to do. Right when I had the most conviction, the LPs would be the most conservative.

This means having reserves to follow-on is actually much more about conviction than anything else. The overhead of convincing LPs per deal is fine when times are frothy. This LP strategy can best be described as “buy high”, which is unfortunate. It’s better for LPs to trust the conviction of fund managers and dedicate some of the investing to later rounds.

2. This Is So. Much. Fun.

Talking with founders daily is such a delight. I can do this daily, for the rest of my career. This is true even when there are challenges, where helping solve problems is meaningful. It’s especially fun to see the very earliest stages progress onto real traction and incredible products.

Sometimes it’s visceral, like watching Stoke Space run a hop test for a whole new kind of rocket. Go see the video here. Currently there are 3 companies that have ever flown reusable second stage hardware: NASA’s Space Shuttle, SpaceX’s Starship, and Stoke Space’s hopper test vehicle. Go watch the deep dive on Stoke here after watching the hop below.

Other times, the drama is from the metrics, with some SaaS companies working incrementally to then find explosive growth. The hockey stick is great, but seeing it after years of heads down product and market development hits differently.

3. Know Your Tech

It’s wonderful that ChatGPT is so obviously good that many are working to build in the AI space. This appears to come at the cost of founders choosing robotics and hardware companies. YC batches went from dozens to single digit robotics efforts. But the opportunities in pure software are real and compelling.

With a buzzword-filled trend, you need to watch out for people that don’t know the tech. It’s now more important than ever to be able to understand what is possible and what isn’t. And all the startup fundamentals still matter.

For example, some investors dismiss products by saying they’re “ChatGPT wrappers”. This is naive because you can fine-tune open source models to beat OpenAI on price and performance, and then you’re still using AI like an API call either way. But this also ignores so much else that matters, like access to proprietary data from customers, the problem in the market you’re solving, the quality of the user experience, how you reach customers, and so much more. It’s like dismissing a company because they use MySQL.

Fund III Coming Soon

We’re no longer raising for Fund II, but my plan is to raise Fund III starting at the end of the year. Like Fund I, this will be a 506c fund, which means I can openly talk about the fundraise.

The main reason to make it open is that the network of LPs is valuable for companies, so getting folks from Twitter and Substack makes for surprising new friends.

You can expect the same focus on seed stage AI, ML, and robotics.

If you’re interested in investing in Fund III, please fill out this form.

One More Thing: My New Startup

In addition to running the fund, I’m now running a new startup, Attention AI. This is my third startup, and I’m excited to tell you more. But that’ll be in a future post. So don’t miss out and subscribe to learn more soon.